So a review, in Lesson 2, we introduced the James Family, earning N500,000 a month who want to prepare a financial plan, with a long term financial goal to own a house in 4 years that costs N8m today. Inflation is projected to stay high. The James Family have a plan to save in a low risk instrument, bank savings to fill their total investment gap to buy their home…

We determined the family net worth at N1.5m with N600,000 in the bank, thus a N7.4m deficit to their plan today. We want to link this to the budget of the James Family, This week we will discuss budgets and how to link the budget to the financial plan.

So to do a budget I recommend a Microsoft Excel application. You will have two sides, one side will the “Projected “items, the other side will have same description and item but will be “Actual” spend. A monthly budget is ok.

For the first month, get a journal, and simply write out all expenses and incomes, note ALL expenses and incomes, write everything down. do this for the first month you want to start your budget.

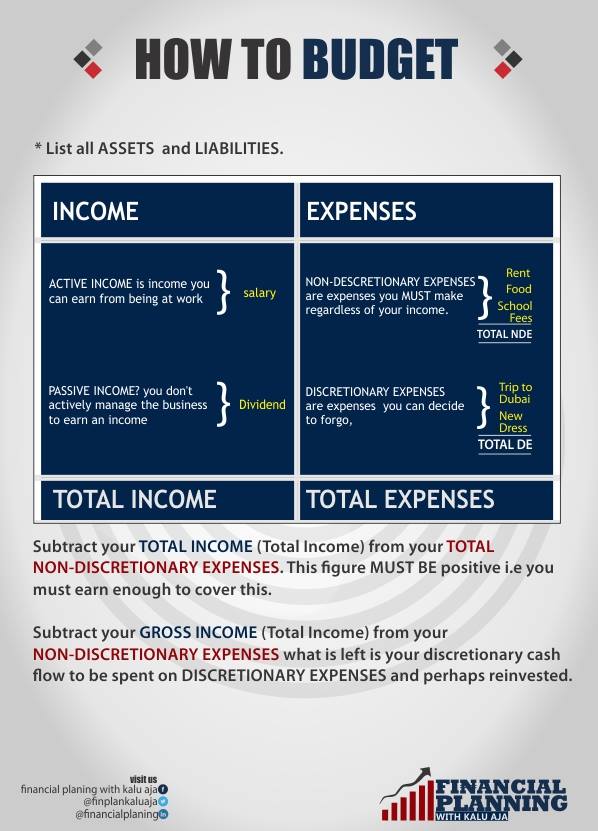

Now we start our budget with income. We have two types of income, Passive and Active income. Passive Income is the income you earn by not personally being present or applying yourself, eg dividends, share of income for a business, rental income. Active income is income you earn from being at work mainly salary and commissions. Note you can be the owner of your own business and still earn a salary thus active income. Active refers to you “actively” managing or working at the company. Passive income? you don’t actively manage the business to earn an income.

So take passive and active incomes from your journal and insert in your excel sheet, keep them separate. If you add both of them you get your Gross Income. Ok? Let’s call this (A)

Next, break down past list of expenses in your journal into Non-Discretionary and Discretionary expenses.

Non-discretionary expenses are the expenses you MUST make regards of your income, eg your investments (B1), rent (B2), food (B3), bank loan repayments,(B4) etc… What can change here is the amount spent, not the item itself. Let’s call this (B)

Discretionary expenses are expenses you can decide to forgo (especially if you lose your income) eg going to watch a movie, holiday in Dubai, some would even argue…DSTV. Lets call this (C).

Now after you do this subtract your Total Non-Discretionary Expenses (B) from your Gross income (A) This figure MUST BE positive ie you must earn enough to cover this. If you have a negative figure, stop here. You plan simply becomes increasing your income or reviewing your Non-Discretionary expense items.

After you subtract your Gross Income from your non-discretionary expenses what is left is your discretionary cashflow to be spent on Discretionary Expenses and perhaps reinvested. This is where you buy the new football jersey, or the new bag…..or increase your fixed income.

So in summary, get paper or a Microsoft Excel sheet application, start with income, Passive and Active. Then do expenditure, subtract gross income from non-discretional expenses. Balance is discretionary cashflow.

End of the month, compare your actual to projected…if you’re spending more on a budget item than projected, you adjust down, spending less?, you ask do you need that expense?

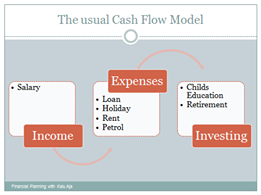

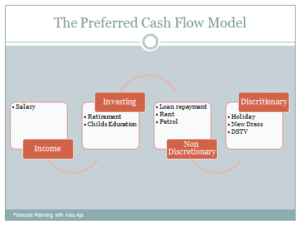

The mismatch most common with preparing a budget is that we tend to go from income to expenses and then we invest the balance.

You hear people say, I don’t earn enough to invest. The reality is if you cannot afford not to invest once you earn. Notice how I list investing as a non-discretionary expense.

So the preferred model is when you get your income, you INVEST, then you pay down your NON Discretionary expenses, then the balance becomes your Discretionary expenses. If possible reinvest all passive income into your savings. Key difference in the preferred model is that you pay yourself first and allow your money to compound (we discussed this in lesson 1). See the attached diagrams on preferred cashflow.

Now an important thing to add is the creation of an Emergency Fund. It’s important you have a minimum of 3 months (I recommend 6 months) Non-Discretionary expenses saved up in a very safe place, no risk. Probably just fix in a bank. This fund is what kick in in an emergency. This is the very first investment you should make. So once we determine the level of our non-discretionary expenses, we start saving towards that.

So back to the James Family, we assume their income at N500,000 a month but let’s also assume they have a net discretionary cashflow of N80,000 a month, that’s all they can save towards their home from their Gross Income. So if we assume the James Family can save this amount in a savings account paying 4% per annum for 4 years, they will get N4,239,669.66 in four years.

However inflation in Nigeria currently at about 9%, in 4 years that N8m home will be worth about N11,292, 652. (If inflation stayed at 9% in 4 years)

The James family gap when they started was N7.6m, after saving N80,000 a month for 4 years, their gap remains N7.05m (cost of home after 4 years N11m from their net savings), in effect, they can’t achieve their plan.

So what should the James Family do? Their plan to save for a home won’t work, so they can’t implement their financial plan. Options?

- They can seek to increase their income from their assets.

- They can look at their budget to cut down on more Non-Discretionary and Discretionary spend

- They can change their overall plan, perhaps increase years of savings?.

These steps constitute the “Control” part of financial planning.

So we stop here and explore these options next week

Financial jargon of the week

What is Treasury Bill?

A short term debt obligation of the Federal Government of Nigeria. When the government borrows money from individuals and institutions, it takes their cash and gives them a certificate called a Treasury Bill. A Treasury Bill is usually called a Risk Free Investment because it’s assumed a government cannot fail to meet its financial obligations…

- Treasury Bill is a financial instrument issued when the government borrows money for 91 days

B. Treasury Certificate is a financial instrument issued when the government borrows money for more than 91 days but less than 180 days,

C. Treasury Bond is a financial instrument issued when the government borrows money for more than one year

Home Work of the Week

Prepare a budget sheet. Break Income into Passive and Active, break Expenses into Non-Discretionary and Discretionary. Then note this…

- Your total income should cover your non-discretionary expenses, it MUST

- Compare your passive income to your Discretionary expenses, does your passive income cover your discretionary expenses?

- Compare your active income to your non-discretionary expenses, does your active income cover your non-discretionary expenses?