Imagine that small vegetable market in your area…..now imagine if the Local Government says certain vegetables are not allowed in that market. ….not banned, just not allowed in that market.

What will you do?

You will go and shop in another vegetable market…..and you take your cash with you….

Hold that thought. …now replace vegetables with dollars…

The CBN (local government ) has created a market for dollars…..but some sectors are not allowed to trade ie buy dollars…..on that market.

What will happen? Same as the vegetable shopper you take your cash someone else.

So lets ask? Why is CBN removing certain items from the market? Because they want to artificially reduce dollar demand on that market.

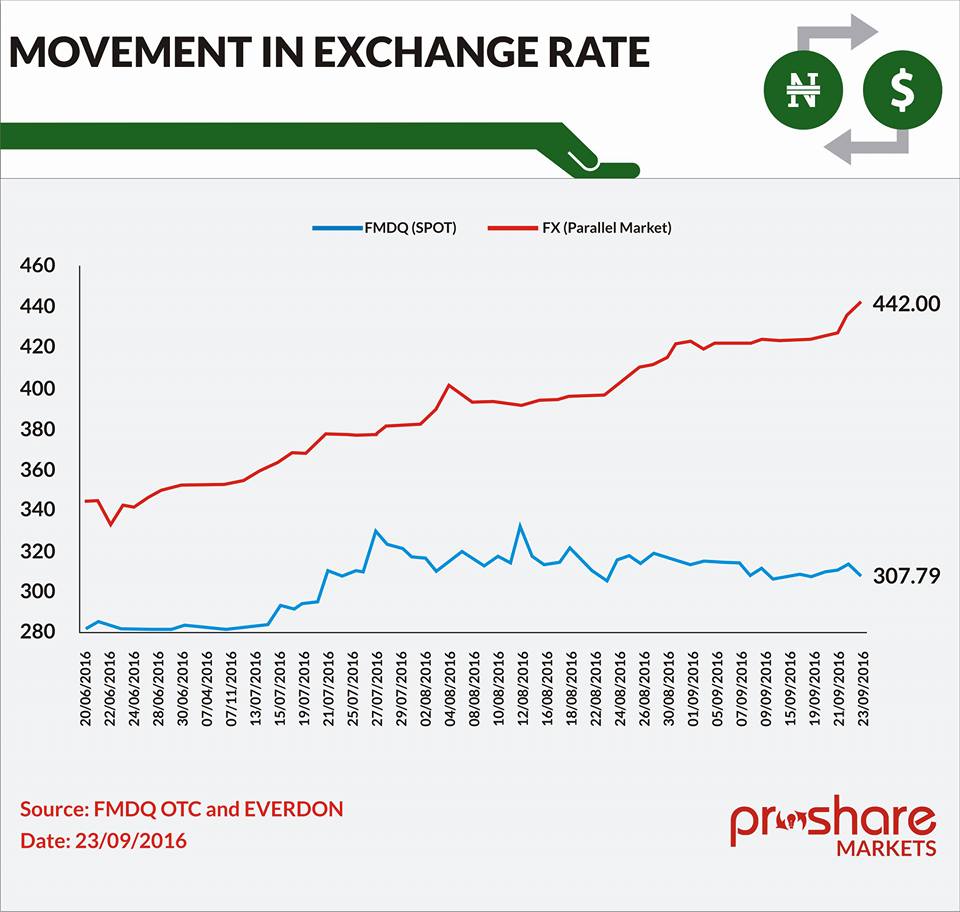

This is like a fat man removing a zero from the scale so instead of weighing 200kg….he weighs 20kg….by restricting access ..the interbank has less demand pressure and thus a lower exchange rate than the parallel market

The other market…the parallel market which has all the vegetables and dollars has more demand pressure and reflects the real demand and supply determined exchange rate of the Naira.

So what is our conclusion?

1. The interbank rate does not reflect the market determined Naira to Dollar exchange rate….

2. The parallel market is a more reflective exchange rate as it includes the full demand and supply pressure of the foreign exchange market.

3. The Naira technically cannot be said to be floated …at best the Interbank rate is a halfway house to a full market driven exchange rate mechanism

4. The only way to reduce demand pressure is to boost supply of dollars. The CBN has to be more innovative in targeting remittances and supplying that flow to manage the market.

If supply of dollar is low…then Naira value on the market will fall.

(Photo credit: Proshare)