The Central Bank of Nigeria (CBN) confirms our position that a fall in Foreign Portfolio and Direct Investment remain the biggest contributor to the recession in Nigeria.

Nigeria foreign currency reserves were not funded solely by oil sales but by Foreign Direct and Portfolio Investment. CBN Deputy Governor Mrs Sarah Alade while giving testimony before the Nigerian House of Representatives said CBN get 70% of its foreign exchange from foreign investors, Her quote is below;

“Things are not the way they used to be. There is a shortage of foreign exchange. In 2013 to 2014, the Federal Government used to get $2bn to $3bn monthly, and the CBN in the interbank market sold about 30 per cent of that. Seventy per cent came from foreign investors.

“Today, we get $600m or $700m. Nothing comes in from interbank market; $1.5m is sold every day and $1bn was done in December to clear matured Letters of Credit. It’s not the way it used to be

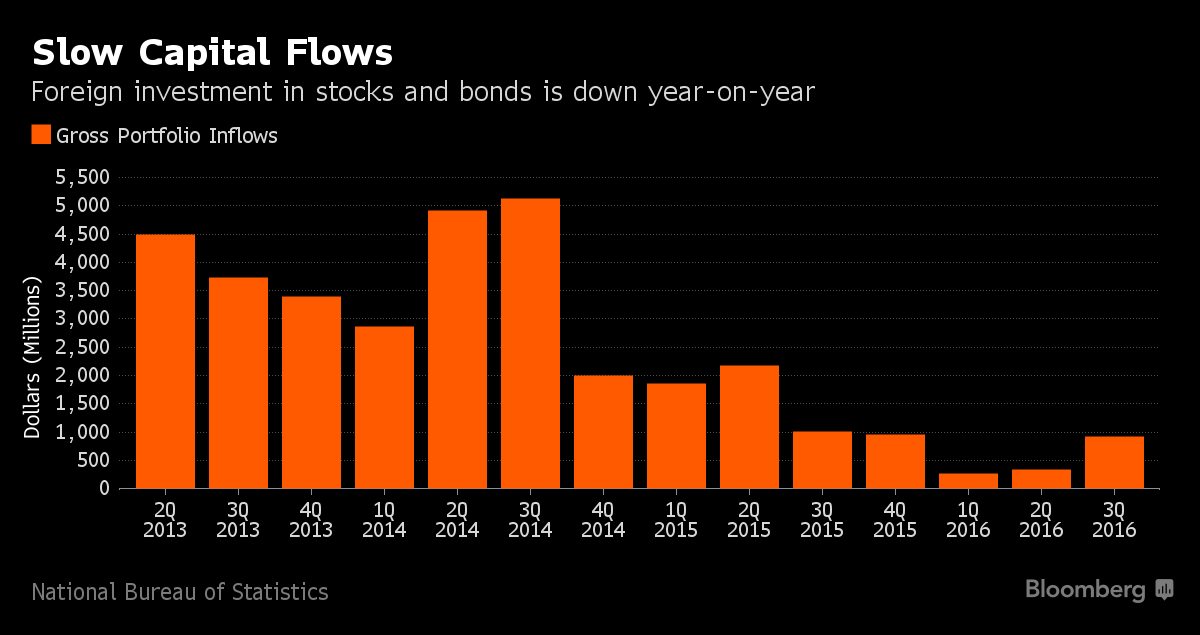

this chart below support that position as investment inflow has dropped off considerable from previous highs

Nigeria failed the JP Morgan liquidity test and got kicked out of the JP Morgan Government Bond index, this reduced the inflow of dollars to the CBN as confirmed by the Central Bank of Nigeria. This fall in foreign exchange to fund imports led directly to the recession in 2016….not just a fall in crude oil prices…..

This is important in guiding policy makers to focus not just on crude oil prices and budget benchmarks but also on policies to re-attract the foreign investors to boost foregin currency investment inflow to the CBN Interbank Market.

Such policies will include a scrapping of the suffocating capital controls instituted by the CBN that has strangulated business in Nigeria

This really adds value to my Research on “Why decline in FDI inflows in Nigeria from 20015 to 2016”

Thank you kalu AJA. please keep me updated.