For the avoidance of doubt, The Treasury Single Account (TSA) is not just a good policy, it’s a timely policy.

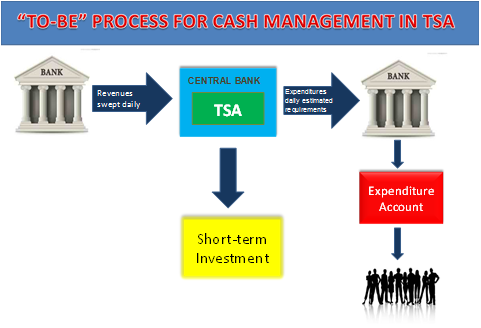

The TSA’s intent is to have all of the government’s accounts under one manager. Where the cash resides if not really the issues, the point of TSA is that the FGN can determine on say Wednesday 16th of September 2015 how much cash it has in the financial system. How much has Customs received? How much has NAFDAC received? etc

Before TSA, it is possible that say NCC may have a cash holding of N20b in bank A, and say NPA will need N20b for a project from bank B. Without TSA, the FGN will be forced to bear the bank interest rate charged to NPA by bank B, meanwhile it has N20b sitting in bank A. With TSA, the FGN will simply direct that N20b NCC deposit to NPA, saving interest cost. Clearly the TSA improves transparency and increase efficiency in the management of public funds, your funds.

Banks are not sacking because of TSA, rather let me rephrase, Banks should not sack because of TSA. TSA does not stop banks from lending to MDAs, neither will it stop banks making money off MDAs via transaction fees. TSA will not stop MDAs paying salaries to staff accounts held in commercial banks, or stop civil servants from taking loans.

The reality is that we don’t have banks in Nigeria, we have some nice building where you can store excess cash and receive your salary…

The Enhancing Financial Innovation and Access EFInA organization does an annual survey of financial inclusion in Nigeria, let me share some findings

1. Only 36.3% of Nigerians have a bank account

2. 61% of Nigeria have NEVER Banked in their lives

3. Of the number of Nigerian Politicsns who bank, 93% have Savings Account

4. 76% have debit cards

5. 27% have current accounts

Then the fun part

6. Only 2.6% of Nigerians have a banking product that has a loan

7. Only 1.1% of Nigerians have a banking product that has an overdraft

8. Only 0.7% of Nigerians have a banking product that has a mortgage loan

So what have commercial banks been doing in Nigeria that 61% of the adult population have NEVER been banked? If commercial banks have held FGN cash and bank loans are still priced at double digit rates, then why is the FGN cash in the banks in the first place?

When a bank lends, it takes a risk. To compensate for that risk, the bank charges a fee, otherwise known as interest. A bank is thus reasonably expected to make money from loaning out deposits to business. From the EFInA data, we see they don’t, or better still, to a small slice of the population.

Banking business as defined by the BOFIA is ” the business of receiving deposits on current accounts, savings account or other similar account, paying or collecting cheques, drawn by or paid in by customers; provision of finance or such other business as the Governor may, be order published in the Gazette, designate as banking business;”

The Nigerian banks have been good in deposit mobilization but asleep in the “provision of finance” part. The banks in Nigeria have concentrated in Lagos state, have opened “tick the box” branches in the rural areas, but clearly the Nigerian banks are not interested in rural banking. The Microfinance banks are simply doing what the commercial banks are doing, under a different name.

However the banks are commercial entities, capitalized by the shareholders to make a profit. Why should a bank lend to a farmer or hairdresser, and incur a risk, when the same bank can lend to the Federal Government of Nigeria for 16%…risk free? Most bank simply collect saving deposit at 3% and lend to the government at 10% risk free…..whose fault?…well commercial banks don’t set interest rates in the economy, the CBN does.

So the Nigerian banks have to go back to basics, banks in Nigeria is simply run as high cost centers, Nigerian Banks are chasing the same urban customers, no one is thinking, bank products are all the same…no differentiation.

TSA just shows the Nigerian banks are sitting ducks….should a Chinese or Indian bank enter Nigeria, they will be smart to go after the rural population who may deposit only N100 a quarter, but are not affected by TSA….

“Nigeria has higher levels of banked adults than Kenya, Rwanda and Tanzania. However, Kenya and Tanzania have a higher percentage of formally included adults mainly due to the high uptake of mobile money in these two countries”. In Kenya, it’s possible to pay in a mama-put with your mobile phone, mobile banking is that embraced. In Nigeria only 1.6% use mobile banking and only 3.5% use internet banking. Shocking!

In summary The Nigerian banks need to fix their demographics, they need to reach the rural areas and crate new products that will appeal to the demographic, to insulate their deposits from “TSA”…

The Chinese are already at the gates…

its our problem, we can fix it

(Photocredit: www.depedbukidnon.net.ph)