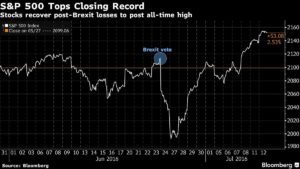

Brexit caused the markets and the British Pound to fall

yesterday it’s back up….slightly…..was a buying opportunity missed? …or is this just a blimp?

what lessons can we learn?

1..when investing, keep in mind price and intrinsic value are very different concepts. it’s important to buy when market prices are below the introstic value.

2. pick your strategy, if your plan is to diversify into a particular sector, as part of a long term goal, stick to it, a market crash presents an opportunity to pick up blue chips at bargin prices.

3..learn about Average Cost purchasing. ..basically if your research shows a stock to be “underpriced” and you want to build up a position in that stock, simply buy the stock constantly irrespective of market prices, the average costs of your purchases should average out. …simply put avoid attempting to “time” the market.

4. don’t panic…don’t follow the herd, do your numbers, understand the underlying issues, gather relevant information …Warren Buffet said “be careful when other are bullish…..be bullish when others are careful”

Summy

1. Strategic patience

2. Never panic

3. Act only on fundamentals

4. Hedge

5. Recognize opportunities

(photo credit: Bloomberg)