What should be a reasonable response to a falling Naira, inflation, rising dollar and job losses? Creating multiple sources of income especially by exporting to earn forex is a good response.

Multiple streams of income provide “insurance” to you in the event of an unexpected job/income loss, that eliminates your active income. in financial planning terms, multiple streams support your budget, providing emergency funding to meet your non-discretionary expenses as well as investment capital to grow your assets.

Earning foreign exchange when you export provides you a “hedge” against a weaker Naira that has lost purchasing power.

Why consider export now? The short answer is that the Naira “devaluation” provides an opportunity to boost your Naira income.

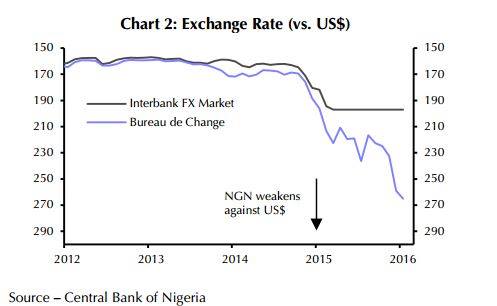

Look at the chart attached, it shows exchange rates from 2012 to 2016, the Naira has weakened against the dollar from about N160 in 2012 to N300 in January 2016. Please note the official exchange rate for the US Dollar from the CBN is N199.

Lets do some numbers, Cocoa price as at December 2012 was $2,109 a metric ton, in 2012, if you exported 10 ton, you made gross export earnings of $21,090 if we convert at an exchange rate of N160, that translates to N3.37m.

However, if you exported the same 10 tons in January 2016, with a current price of $2,868 at an exchange rate of N300 you get a Naira gross earnings of N8.60m. The difference of over N5m gross export earnings was driven by a weaker Naira.

For exports, a weaker currency generates more gross local earnings.

With this in mind, we will start a short series on exporting, a guide to how you can tap into the export markets.

Please note you can approach this opportunity as a passive investor or an active one, for both you need the right information.

The information is what will be provided.

Do follow…