In lesson three, we reviewed the James family, who have a gap in their housing plan.

Even after saving N80,000.00 for 4 years, the James Family fell considerably behind in accumulating sufficient capital to meet their goal of buying a home. The house prices kept rising, and their investment returns could not match that rise.

The James Family had a positive net income flow with good discretionary cash flow from their monthly budget. The problem was their Asset Allocation was faulty. So what is asset allocation?

Asset allocation is an investment strategy to balance risk and reward by sharing your assets according to goals, risk and time horizon. What every investor wants to do is match investment goals to available asset classes taking into consideration the risks the investor can bear and external factors like inflation.

Let talk on risk, if you have a spectrum, Preservation of Capital will be on one end and then Capital Appreciation on the other end. If the objective of the investor is the preservation of investment capital then the investors risk profile is low, If however the objective is the appreciation of investment capital then the investors risk profile is high

Remember The James Family had a long term goal, with a low risk appetite. Thus they choose a safe bank saving account. This ensured they were able to preserve their capital but their capital was not able to appreciate in value to beat inflation and give them a real rate of return.

Now lets discuss assets, a broad classification of assets will be fixed income investments like the FGN Bonds which return a fixed return or Variable return assets like Stocks whose returns are not fixed. When investing, with an expectation of a fixed returns, the investor should invest in fixed income assets and vise versa.

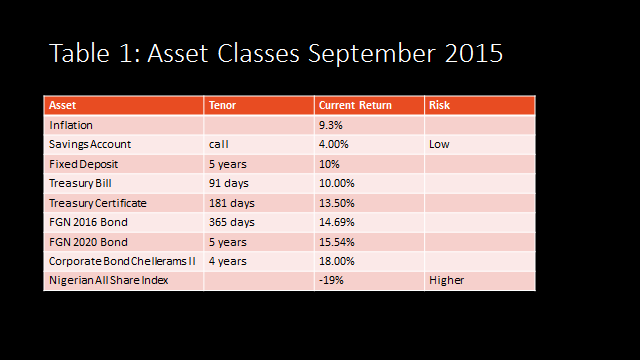

See table 1 Asset Classes September 2015 below, it’s a schedule of assets, with their tenors and risk. First thing that jumps at you is that the saving rate today(4%) is below inflation(9%), this means any cash in saving does not return a real rate of return, as at today. So if you’re saving for a long term goal, and seeking capital appreciation, your money should not be in any investment that pays less than 9%.

Table 1 also shows that a rational investor will seek a higher return as the time horizon is longer, thus, the FGN 91 day investment has a lower return than the a FGN 5 year investment.

Table 1 also shows that investing in shares or equities is very volatile, today September 2015 the Nigerian Stock Exchange Index is returning negative 0.19%, however in 2012 the NSE Index was returning 47%, in 2013, it returned 47.2%.

So back to the James Family, they had a fixed return expectation, and a low risk appetite, so they choose an asset class, saving that returned a fixed rate. The problem was the savings return didn’t beat inflation.

We proposed the below solutions to the James Family

- They increase the returns generated from their assets by taking them out of savings.

- They can change their overall plan, by extending the years of savings by one year.

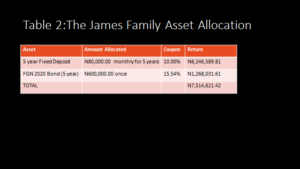

In Table 2 we have proposed a sample asset allocation for the James Family. Table 2 shows a Asset Allocation schedule for the James Family. The target is to increase the James Family earning but within their risk profile while matching their duration.

First thing we have done is to extend the time horizon for investment for the James to 5 years.

We have put their bulk saving of N600,000.00 in a 5 year FGN 2020 Bond that pays 15.54%, still low risk. Their interest is now 15.54% as compared to 4% in the savings account.

We then advise the James to set up a standing order debit to invest their N80,000 a month income in a Fixed Deposit with a bank that pay 10% pa. Thus every month, the family invests N80,000. In total, we get a net of N7,514,621.42 over five years if rates remain the same.

So what about the balance to buy the home? Clearly the income level of the family cannot purchase the home. As they save, the home prices is still rising even though the gap has been reduced. Thus we propose the outstanding balance to purchase the home be borrowed from a bank meaning the James Family will go in debt..

Thus let’s stop here, next week we discuss how to determine, how to borrow responsibly and how to repay loans and manage debt.

Financial Jargon of the Week

What is yield?

The income return on an investment. It is usually expressed annually as a percentage based on the investment’s cost, its current market value or its face value. Thus if I buy a bond for N1000, and the bond pays me N100, my yield is the income (N100) divided by the Cost (N1000) as a percentage so 10%.

This is different from a coupon which is the interest rate stated on a bond. The coupon is typically paid semiannually. In this example the coupon is N100.

A dividend is a distribution of a portion of a company’s earnings, decided by the board of directors, to its shareholders. Dividends can be issued as cash payments, as shares of stock, or other property. Normally dividends are for equity investments.

Again using our example, if I invested N1000 in Nestle Plc, if Nestle pays me a dividend of N100, my Dividend yield is 10% (N100/N1000) x 100

Question of the week:

is there truly any risk free investment?