Ok so in lesson 6, we concluded the discussion on debt.

This week we are looking at targeted investment plans for example a retirement plan or a child’s education plan.

Now the most important financial plan you can and should have is a retirement plan. Your retirement plan is even more important than you child’s education plan.

A successful retirement plan is based on a successful investment plan, and a successful investment plan is based on early, steady retirement savings over time, and the earning on those contributions. So in designing a successful retirement plan what are the steps?

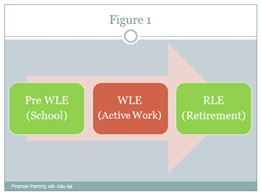

First, determine your Work Life Expectancy WLE, this is the period of time you expect to be in the work force. Eg if your 30 years old and you expect to retire at age 65, your WLE is 35. WLE purpose is important as it signifies how long you have to accumulate and save towards retirement.

Now the next thing to determine is your Retirement Life Expectancy RLE, this is the time from retirement till death. In figure one, we have three stages, the Pre WLE, the WLE and the RLE. You only earn during the WLE period, this is the period you accumulate and invest your earnings. What you earn and save during your WLE should fund your consumption in your RLE period. If you don’t save during your WLE period, you expose your RLE period to peril.

Retirement is also a financial event. Retirement should equate as the period when your passive income can fund your RLE.

In lesson one we posted… “When you put money in a bank, you earn more when your money has TIME to compound.” The earlier you save during your WLE is very important and it has a huge impact on your final return.

In Figure two you see a schedule that costs out delays in investing for your retirement. In this example the WLE is 65.

Now if the clients invests N200 per month at 7% when he is aged 20 years, he will have N239,000 in 45 years.

If the same client invests N200 per month at 7% when he is aged 35 years, he will have N82,000 in 45 years.

Thus a delay in starting to invest for retirement for 15 years, costs the client N157,000. Specifically, if you don’t have a Retirement Saving Account, open one today, and start contributing

So a retirement plan is based on first a calculation of how much you suppose you will need in your RLE period. When you get this figure, you then determine what to save during your WLE period so you walk backwards…..

Eg you are aged 30, you want to retire when your 60 years old, this means your WLE is 30. You determine your RLE is 30 years. You also determine you need N1m a year in retirement for your 30 years (RLE), thus your expected spend during retirement is N1m x 30 years or N30m….

So the question is how much we should accumulate in 30 years, so that we can buy an investment that pays you N1m a year for 30 years. Assume interest rate of 7%.

To solve this we calculate what is called the Present Value of an Annuity….and the answer is N 12.4m. So during the client’s 30 years WLE, he has to accumulate N12.4m in saving by age 60,

It’s this N12.4m that will be used to buy an annuity

So this is how you plan for retirement

- Determine projected income need during RLE

- Determine lump sum to be invested at retirement age to fund RLE

- Work back to determine how much of annual saving is required to fund lump sum

- Compare yearly pension requirement savings to actual saving, if lower increase pension savings

So this is a good introduction, we will do another example on saving for retirement next week to drive this home

Financial Jargon

What is an Annuity: an annuity is basically a fixed sum of money paid over the life time of a person, in consideration of a lump sum paid by the person. In effect you give the Insurance or Pension company a bulk sum of money, they commit to pay you a fixed sum, every month, quarter or year for the rest of your life.

Question

If you have to invest N10,000 in either your child’s education saving plan or your retirement plan, what would be the better investment option? Why?