The Nigerian economy is diversified, it’s 50% Services. Crude oil as an industry is about 20% of the economy.

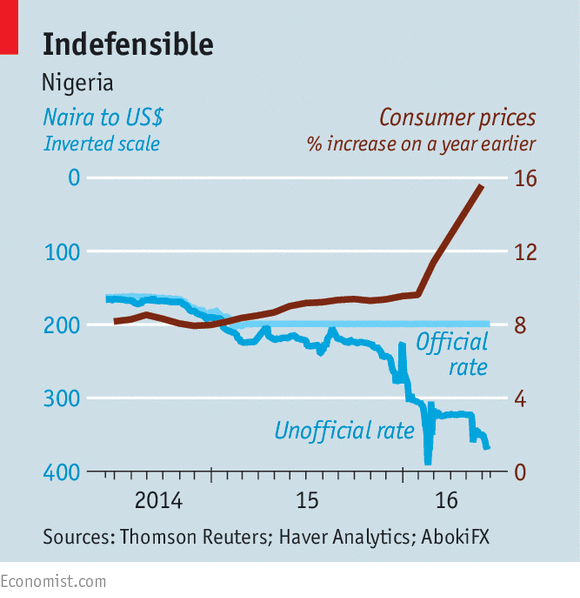

The problem is the Nigerian economy has only one major source of foreign currency earnings which is crude oil and gas. Once crude oil prices fall our ability to fund imports that drive local manufacturing and the trade industry is impared, leading to job losses, price hikes and fall in consumption. This can be ameliorated if the economy attracted foreign exchange flows from other sources…

The problem as I see it is many especially many in government see a weak naira as an indicator of a weak economy.

Nothing could be further from the truth.

A weak currency boosts exports from Nigeria because those export items are cheaper in relation to exports from “stronger” currencies and also makes imports into Nigeria expensive…but it also fuels inflation. What Nigeria needs now is a weak currency….not a strong one…the economy today will struggle to survive at exchange rates of N100 to $1. At this rate, Nigeria will not generate sufficient foreign exchange revenues to cover our local obligations on just oil and gas exports.

Nigeria economic issue today which is a fall in supply of foreign exchange is solved primarly by boosting exports…inflation we can deal with later on.

The government must get creative and support exports….especially non oil exports

The Central Bank of Nigeria will invest in a NEXIM debenture to the tune of N500b to boost non oil exports, this is very welcome. It’s very important these intervention funds are accessed by real SME exporters to drive the growth in non oil foreign exchange earnings.

It’s important to caveat that currency exchange rates alone won’t boost the economy. ..the logistics and other ease of doing business issues must be addressed as well.

To “save the naira” by local patronage of made in Nigerian goods ie import substitution is very good but this must be accompanied by a plan to Export..Export …Export

(Photo Credit: The Economist)