What are Sukuks?

A Sukuk is as Bond…but it has a key difference.

With traditional bonds, a borrower receives funds from investors in exchange for a document called a bond. The issuer of the bond, (the borrower) has a contractual obligation to repay to bond holders (the lenders) on certain specified dates (usually 6 months), a fixed repayment of interest and principal, no matter what. Key point, a fixed interest is paid

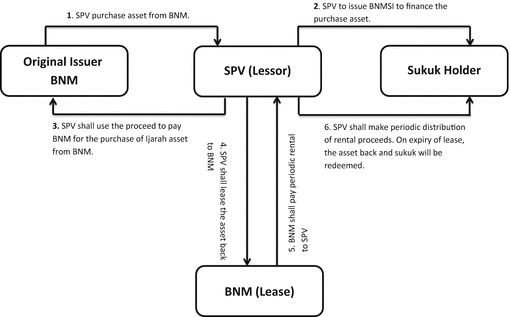

A Sukuk is a Bond that seeks to avoid the payment of that fixed interest because the religion of Islam prohibits the payment of interest to lenders. So Sukuk’s are essentially bonds that own the assets they are financing. In other words, Sukuk’s are asset backed bonds NOT debt bonds. Investors in Sukuk’s are deemed “owners” of the asset they are financing, thus instead of interest payment, the investors receive share of profits (and losses).

This is how Sukuk’s work; The FGN owns a road. it needs cash to fix them. it creates a company called Nigerian Roads, transfers ownership of identified roads to that company. The FGN then issues a Sukuk Bond to fix the roads “owned” by Nigerian Roads. When investors buy the Sukuk Bond they technically own the assets of Nigerian Roads….which are those roads transferred

The Roads being financed are “sold” by FGN to the Sukuk Holders who then “lease” it back to the FGN, (the N100b Sukuk bonds are Ijarah (Lease) Sukuks). The Sukuk holders “own” those roads. Consequently, Sukuk holders are entitled to a share in the revenues generated by the assets they are financing, in this case Nigerian Roads. (remember this)

What is Good about Sukuk’s

The Nigerian Federal Government has recently shown zero commitment in actual CAPEX spending from revenues. The bulk of the FGN Revenues and record local borrowing have gone towards financing the budget deficit rather than fixing roads. A Sukuk Bond forces the FGN to direct borrowing towards Capital Expenditure only as Sukuk cannot be debt instruments.

Sukuks are however a prudent means to ensure government borrowing flows only to Capital Expenditure as Sukuks are Asset Backed Bonds

What Are The Questions About Sukuk

First, The Director General of the Nigerian Debt Management said “Nigerian N100b Sukuk Bond is a safe low risk investment” if the bonds are low risk, why are “rentals” (Interest rates) on the Sukuk payable 16.47%? There is a similar 2024 FGN Bond for the same duration of 7 years with a yield of 14.20%

Secondly The 16.47% represents the rental fee the FGN pays to the “owners” of the roads, question is how will roads generate 16.47%? by road tolls? will thees roads be tolled?

Lastly Sukuk laws do not encourage guaranteed Income but profit sharing, Sukuk holders should receive rental payments from trading on their assets. Should Sukuk guarantee a return irrespective of performance of underlying assets ie (road toll collection)? if trhey guarantee then it becomes fixed income ie intrest. If Sukuks are issued at guaranteed “rental” rates they lose their “Profit and Loss” sharing tenents are are no longer “ethical”…

What Next?

Next logical step is to issue Sukuk Mortgage Bonds linked to individual Pension Assets in RSAs to develop affordable homes under Rent to Own.

Image Credit: ImageCredit.net