The Background

The Nigerian economy posted a GDP decline of 2.06% in June 2016, as compared to 0.36% in March 2016 implying two negative GDP quarters, so formally Nigeria is in a recession. The last recession Nigeria experienced was 12 years ago, in the second quarter of 2004.

This paper seeks to establish why the economy slid into a recession, and what lessons can be learnt from the by the Organized Private Sector and the Government.

A refusal to Devalue

In the last two years, crude oil prices started a slow but steady decline from a peak of $110 to $38. The direct consequence of the decline was that the Nigerian foreign reserves became exposed, especially as the Central Bank of Nigeria (CBN) took devaluation of the Naira off the table and pegged the value of the currency the Naira to N197 to $1. The CBN also imposing capital controls set the stage for Nigeria exit from the JP Morgan Government Bond Index.

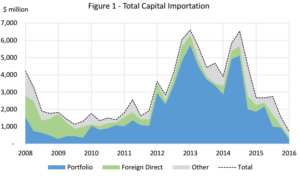

Capital importation falls

The total value of capital imported into Nigeria in the first quarter of 2016 fell by 73%, year on year to $710.97 million, the lowest level since the series began in 2007. It can be argued the refusal to devalue and JP Morgan led to the fall in capital importation not the fall in crude oil prices.

The CBN faced with a 73% drop in capital importation, decided to “protect and defend” the foreign reserves via a series of administrative measures, in essence the CBN put its foreign reserve stability as the number one strategic goal, this made a bad problem worse. By listing 41 items, as not eligible for forex the CBN pushed these transactions to the parallel market, and legitimized that market as a market for the organized private sector in Nigeria.

A Refusal to remove petrol subsidies

The Federal Government (FGN)regulates the selling price of petrol, but petrol importers had to buy forex from the unregulated parallel market and sell at the government regulated price. The private dealers simply did not see a profit motive in importing and selling at N87 per liter, this led to scarcity of petrol, strikes and lost man-hours in the pumps. Most importantly energy price hike began to push up the inflation rates.

So first quarter of 2016 saw the economy of Nigeria suffer from a loss of productivity due to lack of petroleum products as well as a high cost of accessing forex by the private sector.

The twin decisions to protect the forex reserves and not remove the subsidy on imported petrol directly caused the complete slowdown of the Nigeria economy and led to the recession.

The solutions have made the situation worse…

The FGN solutions have been too slow and have made the situation worse.

In trying to solve the forex deficit, The CBN vacillated and finally created an “interbank forex market” but restricted many buyers (41 import prohibited items) from that market. To solve the fuel crises, the FGN increased the price of imported petrol, thus increasing the margins to marketers.

The effect of these two polices, has been to increase the cost of production of Nigerian based business. A scarcity of forex, has pushed even approved items to the parrell market, leading to higher production costs, likewise, higher cost of petroleum products has also driven production costs higher. The impact of this higher costs, especially energy costs have been to trend the inflation rate upwards.

Stagflation arrives

The effect is stagflation, i.e. high unemployment, high inflation. High unemployment’s and recent job losses has led a fall in household spending.

THE WAY FORWARD

Reflating Household consumer spending is key.

The Nigerian Bureau of Statistics estimates that Household consumption to real GDP as at 2015 was 68.27%, thus any policy that positively affects this component of the economy will have a direct positive effect on the economy.

As long as household incomes remain under attack any “stimulus” program of the government will not have the desired effect.

The Vice President, Prof Yemi Osinbanjo said, “you spend your way out of a recession” …, agreed. However, we are yet to see evidence of any stimulus. The Finance Minister said in July that N247b has been released as capital expenditures, this is grossly inadequate, it represents less than N2,000 for 160m Nigerians. Of the N500b Social Intervention Fund, only N20b has been released we understand.

Reflating the Household

Household spending is down, Trade as a subsector of the GDP returned a negative GDP growth of (0.03%) as at Quarter Two 2016, this is a red flag. All spending to reflate the economy must address raising incomes of the household.

Tax cuts will have less impact in Nigeria because of low tax to GDP ratio so what is needed is a method to reflate the economy directly. Can we try a reverse VAT? where the consumer is paid back 5% cash back in every purchase? this will ensure we stimulate spending, not just savings.

Reflating the Organized Private Sector

We have bailed out states to pay salaries of workers, it’s important we support the organized private sector to create and save private sector jobs. A job translates to income to the household, thus encouraging consumption.

So reflationary policies must support companies to retain and hire workers, for a start, the private sector cannot be killed with new “IGR” taxes to support the spending by the government.

There are immediate actions that can be taken for example a 50% across the board reduction in import duties, or a 50% deferment of all PAYE and Company Income taxes both Federal and States, taken on the condition jobs are saved.

This will have reduced the Federation income but it’s a direct stimulus as wages are earned and the unemployment rate is kept low.

So what are the lessons from this? For the Federal and State governments?

- The Federal Government must react quickly to events outside its control; whilst energy prices fall outside the control of one government, devaluation is well within the preview of the government.

- The Federal Government must understand perception is as real as reality; When JP Morgan removes your bonds from the index, the perception is often worse.

- All policy objectives cannot be met, chose the option with more payoff to the wider economy, implement it; Nigeria had no reason to retain fuel subsidies for so long if she held unto a currency peg

- Politics must consider economics, as economics will not consider politics; whilst it politicly expedient to have a “strong” Naira, a weaker exchange rate may actually boost export earnings.

In closing, a recession is a natural stage in any capitalist economy, a recession can be seen a severe diet to shed off inefficient economic players. What we must fear is an extended recession that leads to a depression that destroys jobs, household and the economy.

It’s our problem, we can fix it

Kalu Aja

@FinPlanKaluAja